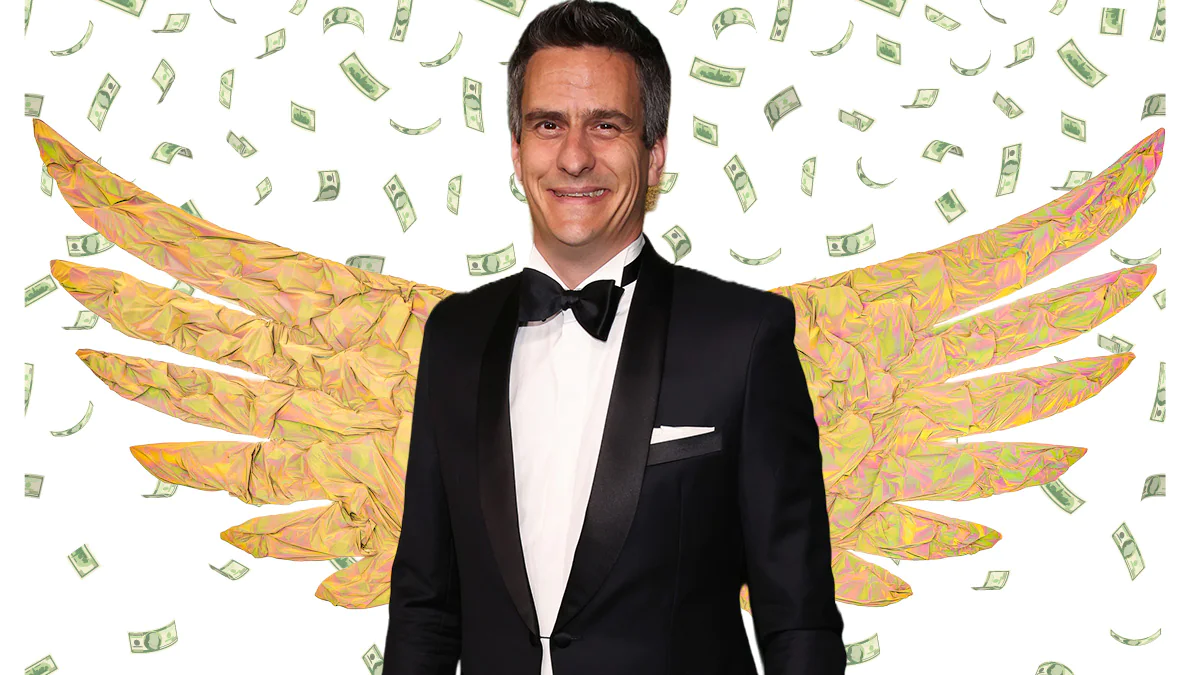

Gunnar Wiedenfels, WBD’s ambassador to Wall Street, has hit the conference circuit to instill confidence in the company, but the stock isn’t bouncing

Wiedenfels has lobbied the company’s case for investors at two of the industry’s most-watched conferences — the Goldman Sachs Communacopia+ Technology event held Tuesday in San Francisco and last week’s Bank of America Securities Media, Entertainment & The Communication Confab was held in Los Angeles. And, by most accounts, they appear to have attracted Wall Street.

Bank of America media analyst Jessica Reif Ehrlich said, “Gunnar is probably one of the best CFOs I’ve seen in my career, he’s very detail-oriented, he works, takes the time and looks at all the details. Huh.” “He goes out there and rolls up his sleeve.”

The only problem is, while the analyst community loves Wiedenfels, investors just aren’t buying what he’s selling yet. Shares of Warner Bros. Discovery are down 50% as of today, closing Wednesday at $12.71, and also fell after their appearance at the Goldman conference.

WBD stock price In what has been one of the market’s biggest disappointments, analysts disappointed that the stock hasn’t been able to gain traction and meet $40 estimates. The stock has not been able to cross $25 since opening for trading on April 4, and has also struggled to cross $13 recently.

It’s so ridiculously low that some of the most famous stock pickers are starting to joke about the studio’s financial fortunes. Last week, Wells Fargo analyst Steven Kahl said in a client note that investors should “buy it with their eyes closed” and slashed his stock price by nearly half to $19.

One of the main issues plaguing investors is that the company ran into nearly $50 billion in debt, mostly as a result of mergers. And, while Wiedenfels said Tuesday that WBD is making good progress in paying off that debt, it still underscores how much risk investors are willing to take.

What’s more, WBD is still scrambling to identify a pledge of $3 billion in cost savings from the bloated entertainment conglomerate, including major redundancies within the company’s streaming services. That means Wiedenfels controls the fate of some 11,000 employees whose jobs may be up to date. “We’re in 150 days, and with any of these transactions, yes there are some surprises,” he told a conference call.

The company “is spending a lot of time completing the synergy program,” he said, sounding a note of optimism. “A great opportunity here is integrating not only two companies but actually integrating five — Warner Bros., HBO, Turner, CNN and Discovery. There’s a lot of opportunity.”

Wiedenfels certainly needs every opportunity he can get under the dark magnifying glass of the financials of Wall Street’s entertainment giant. He’s also taken personal steps as a cheerleader of the company’s potential — selling $500,000 worth of stock in August to send a positive message to investors that he thinks the stock will recover.

One of his biggest concerns is that many on Wall Street expected second-quarter results in August to be a pivotal moment, a chance for all the dirty laundry to weigh on the new company. WBD’s second quarter, reporting for the first time as a combined company, unexpectedly shook the market with a loss of $3.4 billion.

Instead of instilling enthusiasm in declining stocks, the quarterly results created more confusion. Widespread layoffs at a studio known for rampant duplication across its ranks are just a few examples of the company remaking its streaming platform to remake HBO content inexplicably, and its DC film division in a state of chaos. .

“WBD is a streaming underdog whose stock has fallen amid the many counts. The recent cost cuts and production cancellations also don’t bode well for the newly merged streaming newcomer,” said Joy Frenet, a contributor to stock market research and data firm TipRank. “While the odds are stacked against the firm at the moment, I see the valuations as absurdly low and think the company may have an easier time pole vaulting on expectations now that they are essentially near the floor. Huh.”

After promising to make DC the home of superhero franchises like “Superman,” “Batman” and “Wonder Woman”—in rival to Disney’s Marvel Studios, Zaslav just completed the nearly $90 million spinoff “Batgirl,” Aquaman” was delayed. The nine months to December 2023 sequel release and the pre-shot spinoff of “The Flash” seem paralyzed about how to handle it as star Ezra Miller faces physical assaults and even baby grooming. There are many allegations.

So it’s no surprise why filmmaker Dan Lin, who was in talks with Zaslav to run the film unit, decided not to take the job.

People familiar with Lynn’s decision said he was particularly concerned about the shelving of “Batgirl”, a film that had been in the works for years and was nearly completed, so that Warner Bros. would be abandoned after the merger. To take tax write-offs related to the projects undertaken. , But Wiedenfels said Thursday that canning the film was “slightly blown out of proportion” and explained that the company is committed to spending more than ever on content, taking a “more rational approach.”

Every time he steps onto the stage of a convention, Wiedenfels is faced with these challenges and distractions. But those who work with him describe him as extremely friendly, quick and financially savvy, who has proven himself since the recruiting of Zaslav from German television giant ProSiebenSat.1 in 2016. (His current contract with WBD runs through April 2024.)

Beyond the acquisition of Warner Bros., Wiedenfels has helped Zaslav close a number of major deals, including the nearly $15 billion acquisition of Scripps Networks Interactive in 2018, after which he has managed to increase cost synergies through job cuts, department integration, and more. Revealed about $1 billion. and real estate sales.

“No one is going to fool him. They have found cost savings that are really incredible, even with how advertising contracts are structured,” Reef Ehrlich said. “We’ve all known from the old Time Warner days that there’s a lot of wastage and repetition at Warner Bros., and that piece by piece of books takes a lot of wisdom.”

The first major wave of layoffs is coming soon, with hundreds targeted at the company’s advertising sales unit. Karen Grinthal, a longtime Scripps and later Discovery advertising chief who ran Food Network, announced last week that she was leaving the company. His departure came just after he was nominated to drive advertising sales for several cable networks at the company amid WBD’s efforts to sell his vision to advertisers. Ad buyers expressed frustration during the annual “upfront” market that WBD wants advertisers to spend more money running spots on top-rated shows, despite declining viewership.

On Tuesday, Wiedensfels returned to his usual mantras, saying he had “never had any doubts about delivering financial goals” and “there are so many opportunities.” The question is, how long will it take to convince everyone from mom-and-pop investors to big mutual fund managers?