Murphy’s Jeffrey Demar is his first hit since the “Glee” creator joined the streamer in 2018 in a $300 million deal

Murphy’s envy-inducing contract comes a year after Netflix lured ABC broadcast queen Shonda Rhimes to a $100 million deal and then extended it (with a whopping increase) into 2021. The Dreamer then signed “Black-ish” producer Kenya Barris to Nine Figures, horror maestro Mike Flanagan and “Game of Thrones” producers David Benioff and DB Weiss horror maestro Mike Flanagan’s multiyear deal ($200 million). for the latter). But despite the high-profile deals, the results so far have been as uneven as Netflix’s stock price.

Let’s start with Murphy, whose most successful Netflix original before “Asphalt” was 2020’s “Ratched,” which Netflix claimed was viewed by 48 million member accounts within its first four weeks. It dropped out of the streamers’ top 10 by July 2021 before the company adopted clock hours as its primary metric in October 2021. Murphy’s other Netflix work — the miniseries “Hollywood” and “Halston” as well as the two-season series “The Politician” — was met with mixed-to-negative reviews. In an instance where silence speaks a lot, Netflix has Didn’t release any viewership information for those three series (translation: they had nothing to brag about).

Outside of “Dahmer” — which already ranks among Netflix’s top five most in-demand series dating back to 2019, according to Parrot Analytics — any of Murphy’s TV series for Netflix ranks on the platform’s top. 100 is not in the most sought-after series. in that period. (Parrot Analytics searches through social media, fan ratings and piracy data to represent audience demand, which reflects the expressed desire and engagement for a title within a given market). And none match the popularity, or endurance, of Murphy’s FX series “American Horror Story”—a popular licensed title for the streamer.

In its first 30 days this year, US demand for new Netflix Original series premieres averaged 2.86x, which Murphy’s show consistently beat. But while there are always multiple success parameters to consider, including viewership, quality, awards and representation, no TV studio is in the business of spending millions of dollars on content that struggles for big returns. (Murphy’s feature films for the stage, “The Prom” and “The Boys in the Band,” have fared slightly better—though neither of them made it to the streamer’s all-time list.)

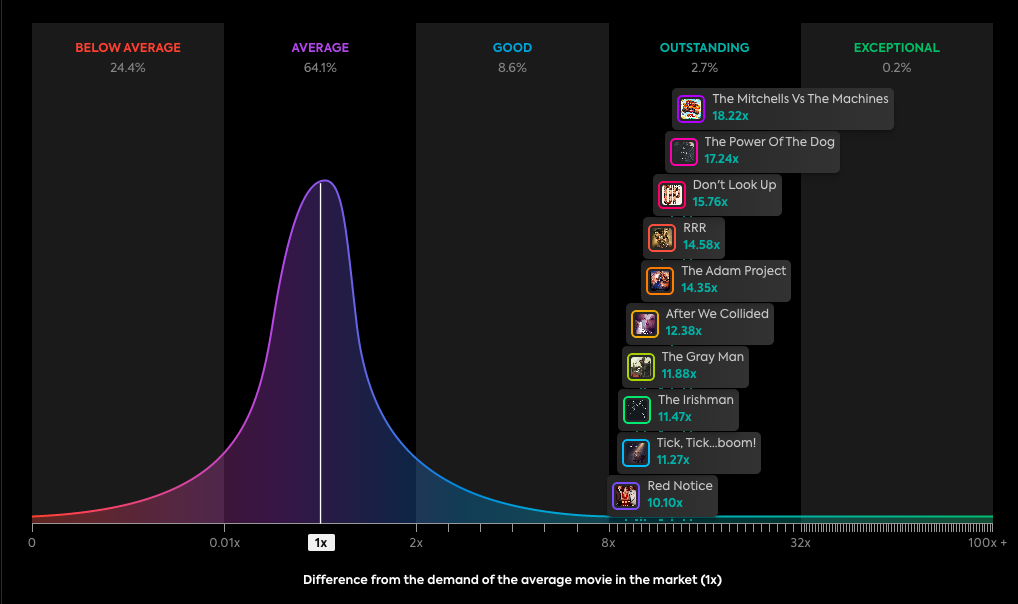

The top 10 most in-demand Netflix Originals in the US from January 1, 2019-September. 30, 2022

Barris’ projects were equally disappointing — and the producer halfway through his Netflix deal after delivering well-received but niche series “#blackAF” and “Astronomy Club.” His latest executive producer credit to the streamer, Kid Cudi’s animated “Antergalactic,” trended in the top 10 of just one region in its opening weekend, according to Flix Patrol, while US demand earned only 2.92x the average performance of the previous week. As a Netflix Executive Told When reports about a possible split with Barris first started swirling, “the idea of doing more prestige shows no one knows isn’t interesting.”

Simply put, studios don’t allow producers to exit contracts early if their content is engaging with audiences and customers.

Meanwhile, Benioff and Weiss had criminally underestimated the Sandra Oh drama “The Chair” (only 5.4 times the average show demand in the US in its first month of availability), falling to the charts on Netflix’s weekly global hours. Was seen in the top 10 for just one week before. closed and will not receive a second season, according To star Sandra Oh. The duo’s film “Metal Lords,” which hooked up to streamers last April, isn’t even in the top 10 most sought-after original movies on Netflix year-to-date.

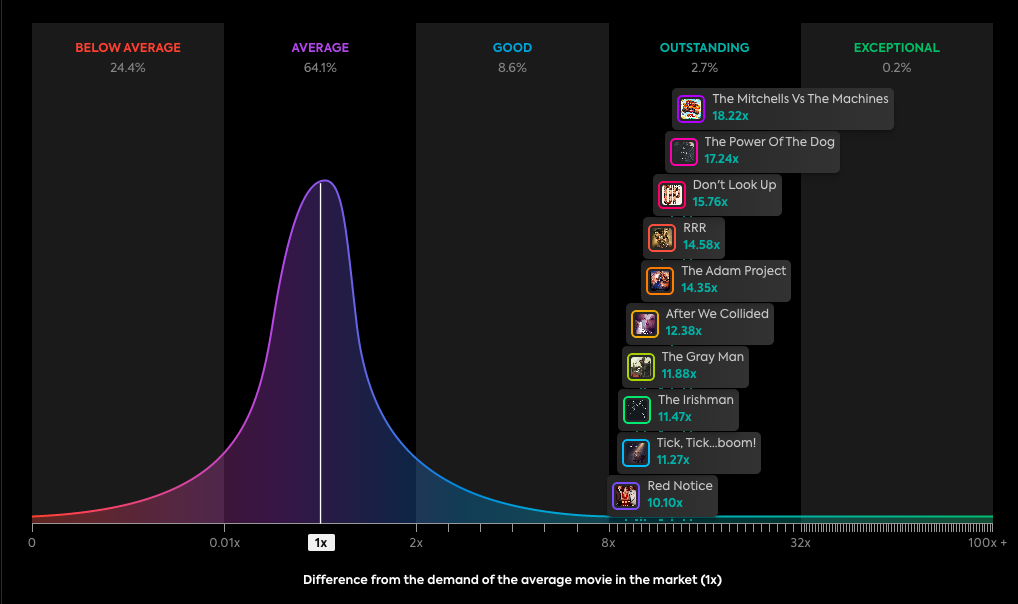

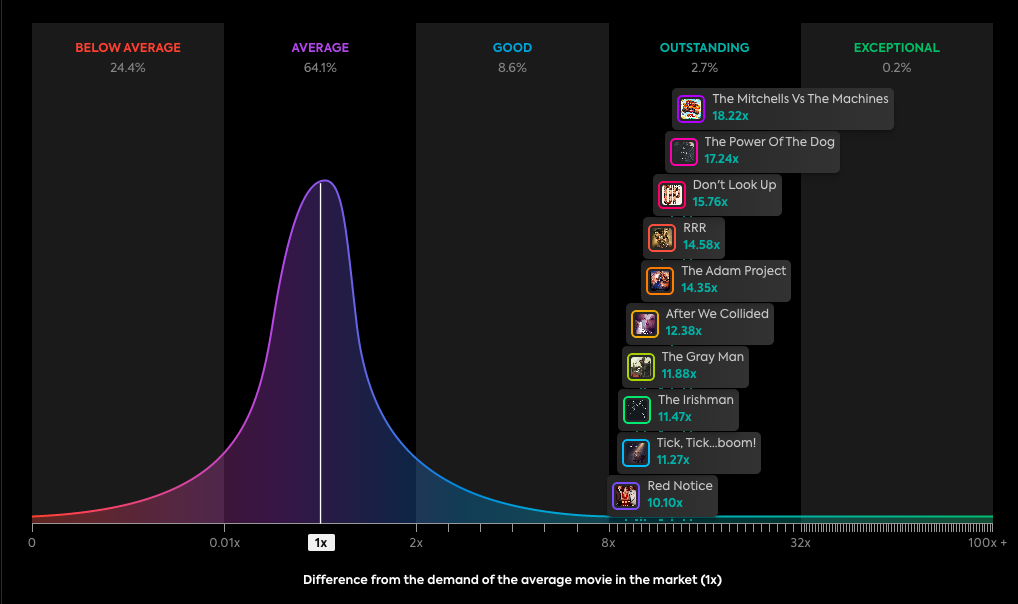

The top 10 most in-demand Netflix original movies in the US, year-over-year.

At a time when Netflix’s financials are under intense scrutiny, these massively expensive deals have failed to return the required viewership, demand and appreciation that would justify their cost.

Yet Netflix hasn’t hit every one of its big money swings.

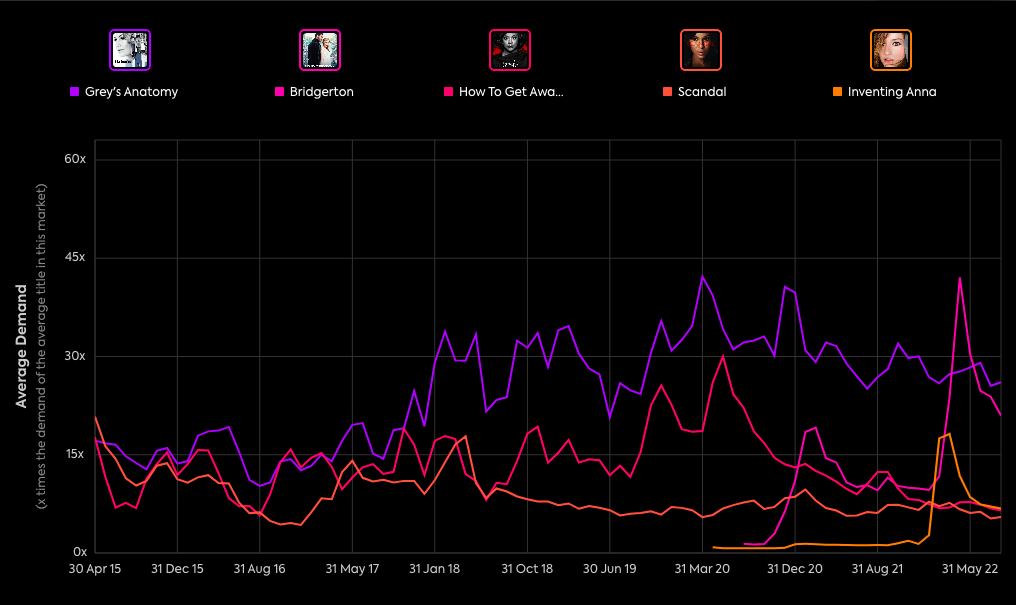

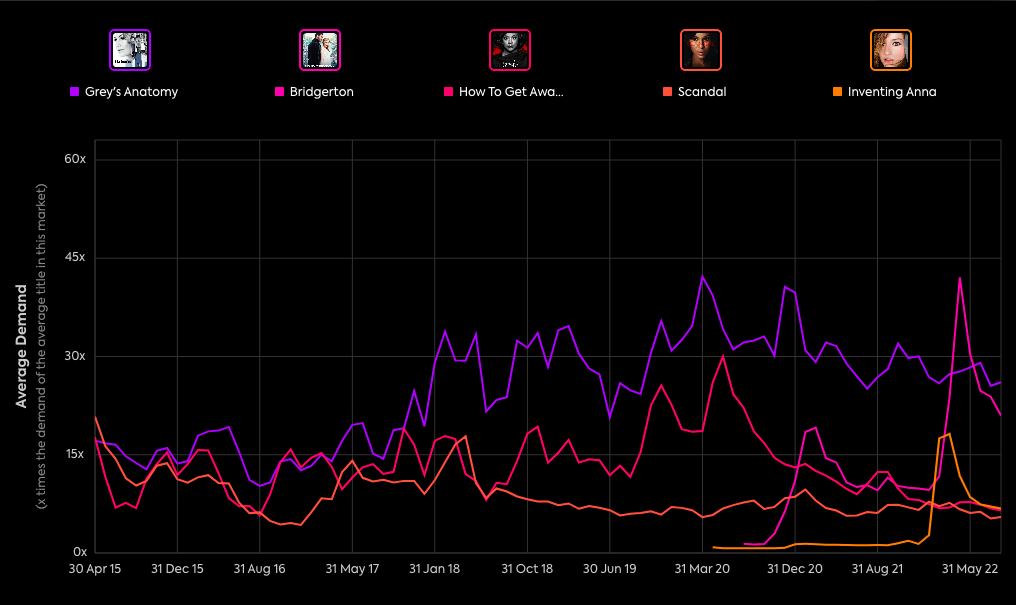

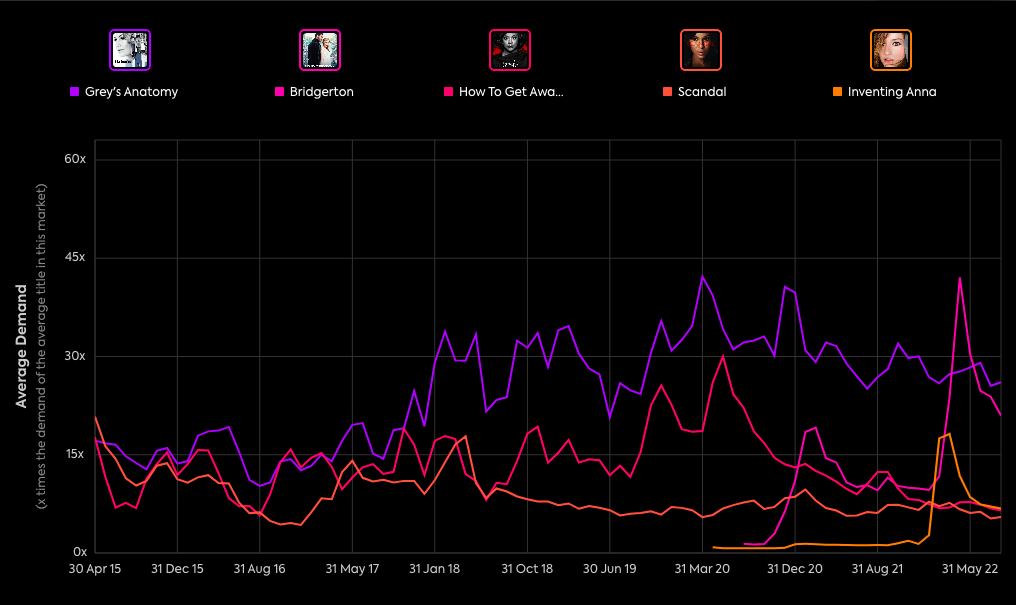

Both seasons of Rhimes’ lustful “Bridgeton” as well as his 2022 limited series “Inventing Anna” rank among Netflix’s most-watched English series of all time in terms of global hours watched in the first 28 days, while Attracting audience demand, Per Parrot Analytics, her first four weeks ranged from “excellent” to “extraordinary.” Also, her ABC series “Grey’s Anatomy” (still streaming on Netflix), “Scandal” ( Removed from Netflix for Hulu in May 2020) and “How to Get Away with Murder” (still streaming on Netflix) has long been a sought-after portfolio of his work – original and licensed titles – acquisition And both as retention tools have been extremely valuable to the streamer.

US audience demands for Grey’s Anatomy, Bridgerton, How to Get Away with Murder, Scandal and Inventing Anna (April 1, 2015-September 29, 2022)

Flanagan has also delivered for Netflix (though we don’t have a reported dollar value on their deal) because their production volumes consistently resonate with viewers before and after their overall deal. The 2018 horror miniseries “The Haunting of Hill House” (23.09 times the average show demand in the US in the first month of availability), its 2020 sequel “The Haunting of Belly Manor” (19.08x) and last year’s “Midnight Mass” (12.64x) All generated higher than average audience demand.

“Midnight Mass” also added 142.2 million global hours watched in its first month of release, which is on par with recent successes like “Echoes” and “Peaky Blinders” Season 6 (we don’t have hours data for “The Hill”). House” or “Blue Manor”). These follow Flanagan’s well-received streaming films such as 2017’s “Gerald’s Game” (21.33x the average film demand in its first four weeks in the US).

If Rhimes is Netflix’s home run hitter, Flanagan is the always-reliable base hitter.

Thanks to the harsh face of Wall Street on the streaming business model and a related slowdown of growth, Netflix has lost $200 million in value to the company over the past 11 months and back-to-back quarterly as an original for the first time ever. The customer has suffered a loss. Content Provider.

Five years ago, the company was still something of an interloper in entertainment for Hollywood to boldly announce (need?). In which new global TV major Bella Bajaria put Netflix’s overall deals business under Brian Wright to write off the most of all nine-figure deals (Wright then left the company in June 2021).

The message was clear, even if Netflix wasn’t saying it out loud: Charging creators exorbitantly wasn’t working. This reality has now become more acute due to the tightness of money.